Zero balance account is a unique banking product that offers customers the convenience of not having to worry about maintaining a minimum balance.

This account is perfect for individuals who want the freedom to deposit or withdraw money as and when needed without having to worry about penalties or fees.

So if you are looking for an easy, convenient and affordable way to bank, then the zero balance account from First Abu Dhabi Bank is perfect for you.

FAB bank offers the benefit of a free savings account via iSave account. This account can be used to save money for short-term needs or long-term goals. The account offers competitive interest rates and no monthly fees.

iSave Account FAB (Zero Balance Account)

The First Abu Dhabi Bank iSAVE account is a great way to save money. The account offers a high interest rate, and there are no monthly fees or minimum balance requirements. You can easily access your money through online banking or at ATMs. This account is perfect for anyone who wants to save money on a regular basis.

How to Open iSave (Zero Balance) Bank Account in FAB bank

Here is step by step guide on opening zero balance bank account in FAB bank.

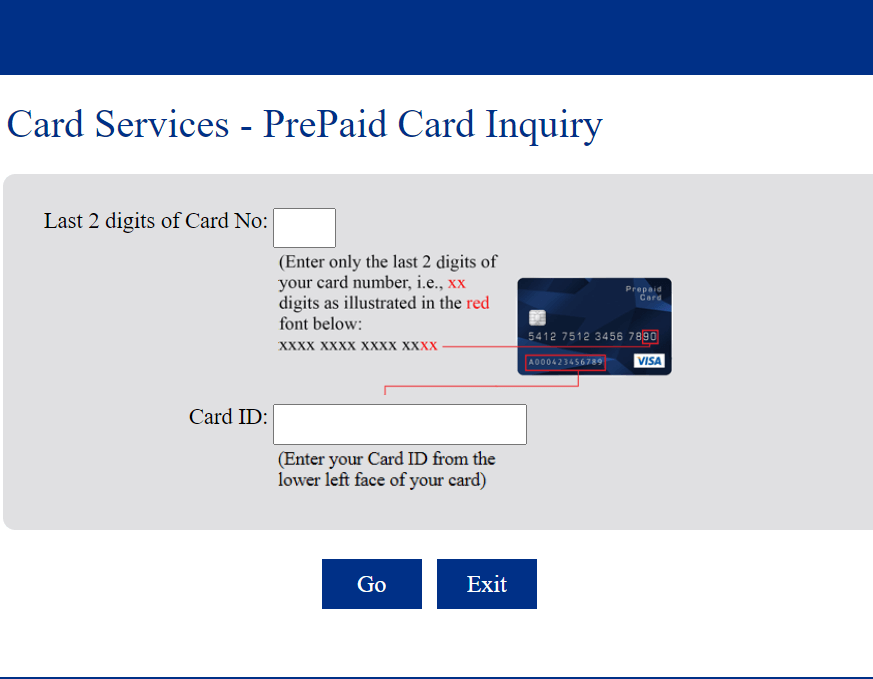

Click on this link https://www.bankfab.com/en-ae/personal/save/isave-account

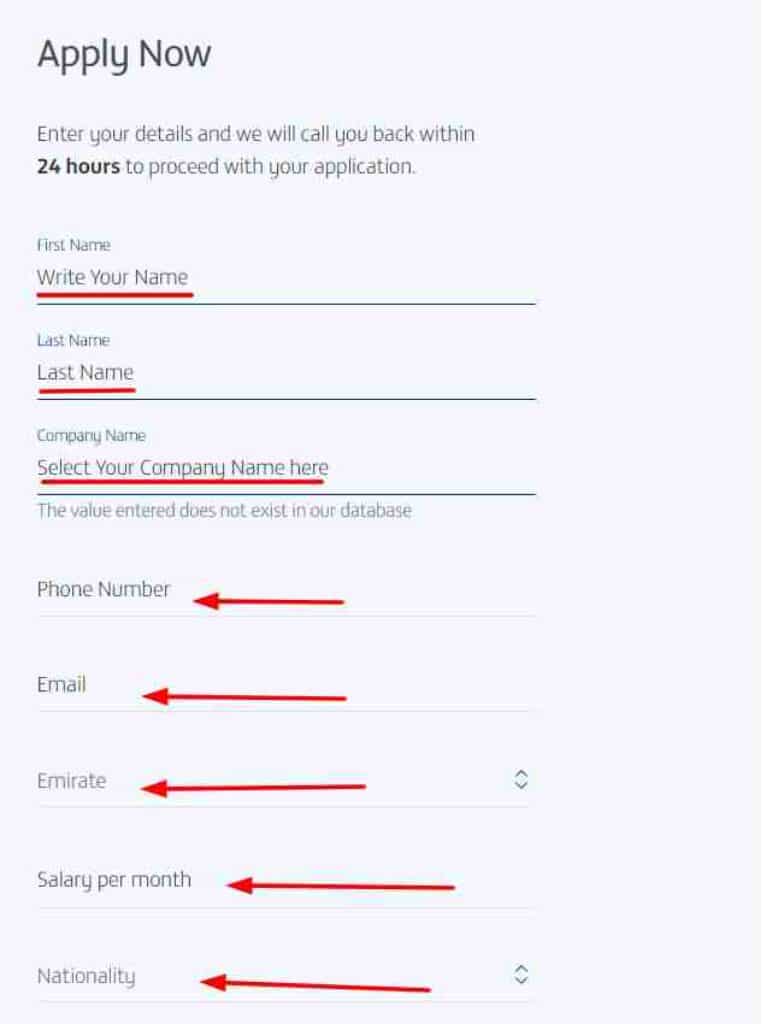

After clicking on the link you will see an application form. Read it clearly and fill all the information correctly. After providing all the information click on apply button to submit your application. A representative from FAB bank will contact you on you mobile within 24 hours of your afflication submission.

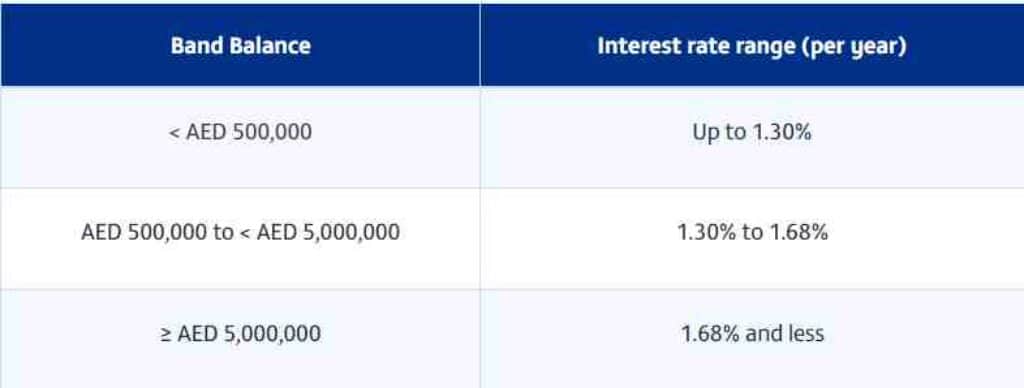

Interest Rates of iSave Account

You can earn upto 1.30% on bank balance of less than AED 500,000 and interest rate for bank balance higher than AED 5000,000 is upto 1.68%. The interest rate for bank balance between AED 500,000 to AED 5000,000 is is between 1.30% to 1.68% Following are the interest rates of iSave bank account

Features Of FAB Zero Balance Account

- One of the best savings rates in the UAE of up to 1.68% per year

- Only for individual customers

- No minimum balance requirement or fall-below fees

- No restrictions on the number of withdrawals

- Interest is paid on your monthly average balance and credited monthly to your iSave Account

- Available in AED only

- Interest is earned on the average monthly balance and calculated based on the ‘band’ your account balance is within. This is called an ‘accumulative band method’, where rates as per different bands will apply

- Interest is credited on the last day of the calendar month

Conditions of FAB Isave Zero Balance Account

- Debit cards are not issued for an iSave account

- Applicable interest rates are at the sole discretion of the Bank and can be changed without notice

- Interest is paid on a monthly basis based on the average monthly balance (calendar month). The Bank reserves the right to change the basis of the calculation of interest at any time and at its sole discretion

- If the account is closed, interest will be paid pro rata using the average monthly balance